Nam Dinh Vu IP is located in Dinh Vu – Cat Hai Economic Zone therefore investors are entitled to the following special incentives:

1. Tax incentives:

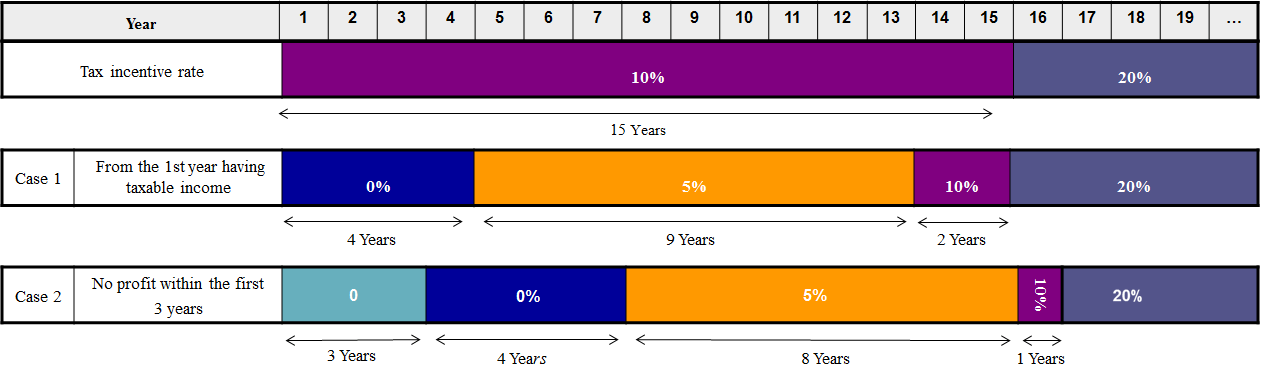

– The corporate income tax rate is 10% for the first 15 years, calculated continuously from the first year an enterprise earn the revenue from the tax incented activities and is equal to 20% in the following years.

– Tax exemption for 4 years, 50% reduction of payable tax for 9 subsequent years, calculated continuously from the first year the enterprise has taxable income from the investment project; In case the enterprise does not have taxable income for the first 3 years after the turnover from the investment project is available, the tax exemption or reduction duration shall be calculated from the forth year.

Land use tax:

Exemption of 100% of land use tax during the entire lifetime of project.

And other tax incentives in accordance with current regulations of the Government of Vietnam. In addition, Nam Dinh Vu IP is also flexible for the adjustment of land lease price, payment term, customer service … in order to create the most favorable conditions for investors.

2. Special Incentives offered by Nam Dinh Vu IP to the investors:

Support the Investors to complete the following legal procedures in the shortest time with free of charge:

– Investment Registration Certificate

– Enterprise Registration Certificate

– Land Use Right Certificate

Nam Dinh Vu IP is located in the center of Dinh Vu – Cat Hai economic zone. This is a marine economic center serving the needs of socio-economic development of Hai Phong city, the northern coastal region and the whole country with many key projects being implemented.

The technical infrastructure and social infrastructure here are developed synchronously and modernly. These comparative advantages bring direct benefits to the investors while saving the transportation costs as well as shortening the products lead time to market.

I. Connection to Haiphong City:

- 10km from Hai Phong city center, connected via TL356 (cross-section 68m).

- Population of over 2 million people.

- 1.3 million labor resources.

II. Cat Bi International Airport

- 8km from the international airport.

- Flight routes: Korea, China, Thailand, etc.

- Designed capacity: 4-5 million visitors/year, ability to upgrade to 7-8 million people/year

- Cargo handling capacity: 250,000 tons/year.

III. Connection to Seaport system

Nam Dinh Vu Port (functional subdivision of Nam Dinh Vu IP):

| Lach Huyen international deep seaport (15 km from Nam Dinh Vu IP):

|

IV. Connection to Highway system:

Hanoi – Hai Phong Expressway:

| Tan Vu – Lach Huyen Highway and Bridge:

| Ha Long – Hai Phong Expressway:

|

V. Connection to Railway system:

– 15km to Hai Phong railway tation.

– The Hai Phong – Hanoi – Lao Cai railway route to Kunming (Yunnan province) in southwest China is extended advantage of Dinh Vu – Cat Hai economic zone.

The Nam Dinh Vu IP have completed all legal procedures and legal basis in accordance with current regulations of Vietnam, as follows:

- The decision No. 208 /QD-UBND of The Municipal People’s Committee dated 16/01/2014 “Ref : Approval on the adjusted master plan of Nam Dinh Vu Non-tariff and Industrial Zone (Zone 1)”

- Investment Certificate No. 022 21 000024 dated 06/05/2009

- Land use right certificate No. BA628667 and No. BA628668 dated 20/01/2010.

- Decision No. 2392/QĐ-UBND dated 27/11/2009 “Ref: Allow Nam Dinh Vu Industrial Park to lease the land in order to implement the project of infrastructure construction and business of Nam Dinh Vu Non-tariff and Industrial Park (Zone 1)”

- For Seaport area: Decision No. 2190/QD-TTg dated 24/12/2009 of the Prime Minister: Approved by the Prime Minister to the Vietnam seaport system planning until 2030, already had the coastline agreement with Vietnam Maritime Administration