The Covid-19 pandemic has greatly affected Vietnam’s socio-economic situation in 3Q2021 when GDP in this quarter was negative 6.17%. Social distancing during the pandemic has brought many productions and business activities to a stop. However, with these efforts, the pandemic and the economy in the northern region have made good signals.

VIETNAM NORTHERN INDUSTRIAL REAL ESTATE

The Northern industrial real estate vietnam market in 3Q2021 received a lot of positive information, despite the spread of the Covid-19, especially in Hai Phong. Thanks to its good control – pandemic capabilities and methods to maintain stable production, Hai Phong City has received good news with LG’s $1.4 billion capital raising project to expand production in Trang Due IP.

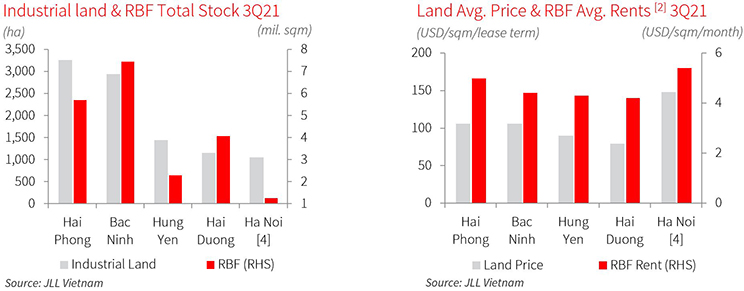

JLL Vietnam’s record in the “Northern Industrial Land and Ready-built Factory 3Q21”, showed that the occupancy rate of industrial parks in 05 key industrial provinces temporarily decreased to 72%, lower than in 2Q2021.

In the southern and northwest provinces of Hanoi, Thai Binh, Phu Tho, Vinh Phuc, etc. are also vibrant large projects with a stable factory market and an occupancy rate of 89%.

In this quarter, Hung Yen province continued to welcome new supply from the expanded Pho Lien A industrial park, with a total area of 93ha invested by Hoa Phat.

In Bac Ninh, Viglacera’s Yen Phong IP has also completed and built a ground base of 70% of the planned area, bringing the total area of industrial land for lease in the North to about 9,900ha.

The market began to record the trend of building high-rise factories, when recently, in VSIP Bac Ninh IP’s high-tech land, a new 7-floor factory with a total floor area of 15,000m2 has just begun construction – JLL Vietnam.

The ready-built factory market had a new supply in Nam Dinh Vu IP, Hai Phong, bringing the total supply of factories to 2.1 million m2.

Industrial parks in Bac Ninh have returned to production since July and FDI continues to pour into the region, concentrated mainly in Hai Phong and Bac Ninh. It helped the average industrial land price in the whole region increase by 6.1% compared to the same period last year, reaching 108 USD / m2 / lease cycle.

Factory rents maintained a 4.7% increase compared to the same period last year, reaching US $4.6/m2/month in 3Q2021.

It can be said that the stability of the Hai Phong and Bac Ninh markets has contributed to maintaining a stable occupancy rate in the Northern region.

The service urban and Industrial real estate vietnam models attract investors

The North is witnessing the trend of investors are accelerating the development of complex real estate models in the North, such as LG Korea Group is expressing its desire to invest in a 304ha Dai Hung industrial, urban and service complex project, with a total investment of nearly US $500 million in Hai Duong; IDICO company is expected to invest in more Vinh Quang serviced urban industrial park with an area of 495ha in Hai Phong.

In addition to traditional industrial provinces, the market also has the development of complex models in new markets, typically the investment research project of industrial- urban – service complex with a total area of about 496 hectares in Yen Bai province proposed by Viglacera Corporation.

Short-term market volatility has little effect on medium to long-term potential.

Due to the impact of the epidemic in 3Q, not only did the number of newly registered FDI projects record a downward trend, but the market also noted that some manufacturing enterprises had to shift orders out of Vietnam to cope with the situation. The shift of orders is currently temporary, however, none of the FDI enterprises have left Vietnam.

Although the long-term social gap has raised concerns among the foreign business community, Vietnam is still considered an attractive destination thanks to its human resource advantages, diverse free trade agreements and government commitments to infrastructure development. If the pandemic is soon controlled, Vietnam will continue to benefit from changes in the global supply chain.